Introduction

MSMEs are considered as the central element of the Indian economy, given the employment, output, and export potential. They contribute nearly 30 percent of India’s GDP and 31 percent of GVA to the $2.7 trillion economy. It accounts for nearly 48.1 percent of India’s exports and generates employment. These enterprises, mostly located in the informal economy, are likely to be the worst hit by the pandemic. Therefore, it becomes essential to develop a support system for the sustenance and revival of the MSME sector.

Major Bottlenecks

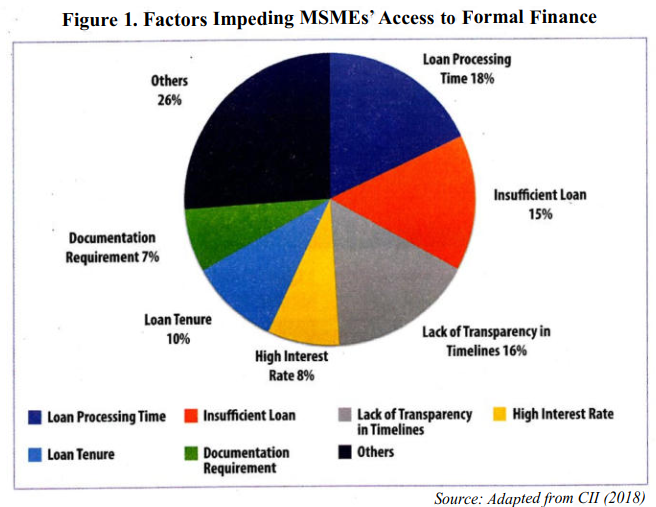

- Lack of institutional finance in MSMEs.

- A high-level committee appointed by the RBI (UK Sinha Committee report’) highlights a multitude of obstacles faced by the MSME sector. The committee too singles out access to finance as the foremost constraint hindering the growth and development of MSMEs.

- There are two principal channels of operations that restrict the flow of formal finance to MSMEs:

- The lack of established credit history.

- Lack of sufficient collateral results in MSMEs’ inability to pay, which makes lending to them risky.

- Delayed payments from corporates, result in increasing Non-Performing Assets(NPA) problem. The average number of debtor days has been above 90 since 1997.

- The results of a survey conducted by the social media site Local Circles reveal that 47 percent of the Indian start-ups and SMEs have less than one month of cash. The survey further highlights that only 6 percent of these firms have resources to tackle disruptions for six months, with 74 percent of these firms anticipating exit during the next six months.

The Informal Sector Enterprises

- The informal sector enterprises have faced many problems due to the lockdown, imposed in the month of March.

- The relief measures like tax reliefs may not have much influence on these enterprises since they rarely fall under the tax net.

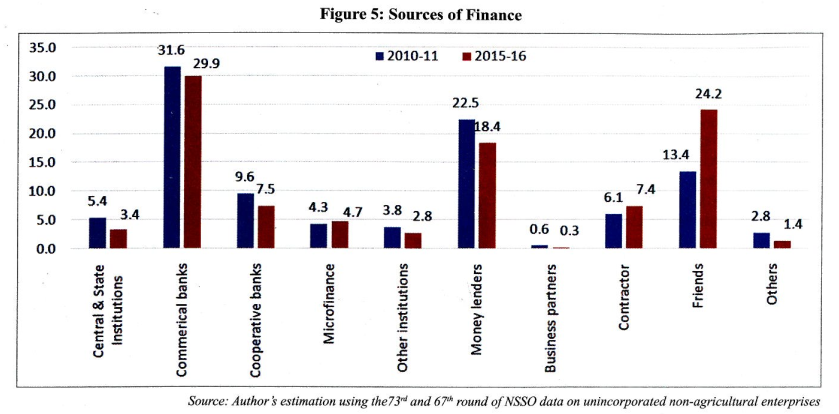

- The vulnerability of these enterprises in terms of lack of financial access is evident from the previous two rounds of the informal enterprise surveys conducted by the National Sample Survey Organization (NSSO). Estimates from these surveys suggest that about one-fifth of

the firms highlight access to finance as a key constraint to the growth.

- Owner-operated enterprises lack credit access, possibly due to the absence of credit history

along with complex application procedures, high interest rates, fear of rejection, high collateral requirements and necessity-driven may possibly be the reasons.

Way Forward

- The current interventions include deferring of goods and services tax (GST) payments till June 2020. RBI has allowed deferment on interest payments on working capital loans for the next three months. MSMEs are further exempted from loan payments till June.

- In addition, the RBI has also introduced Long Term Repo Operations (LTRO) worth Rs. 100,000 crores, enabling banks to lend at cheaper rate, likely to benefit the MSME sector.

- The public sector banks have also set up Covid-19 Emergency Credit Line (CECL) to ease the liquidity crunch faced by MSMEs. Small Industries Development Bank of India (SIBDI), a financial institute set up for the promotion and development of MSMEs have also announced concessional interest rate loan targeted for MSMEs engaged in manufacturing goods or services

related to Covid-19. - However, more is needed to be done to safeguard the survival of the rickety MSME sector, especially in terms of making amends for certain long-term concerns which the pandemic has only aggravated.

- These firms should be advised to use technology in the industries like usage of UPI for digital payments.